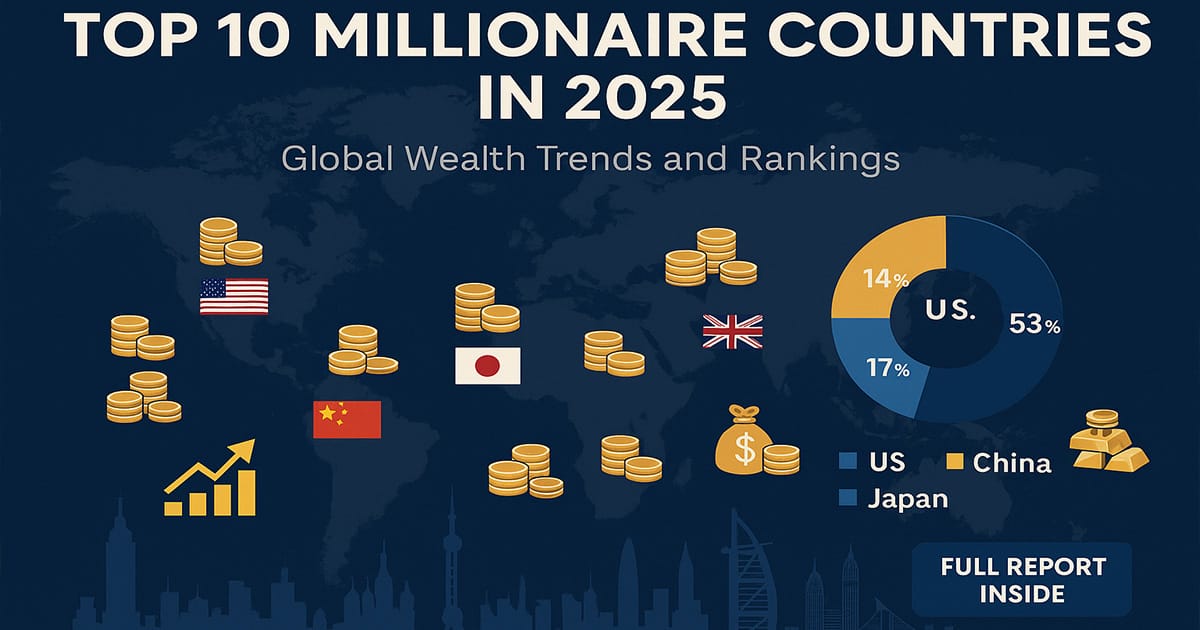

Global Wealth Snapshot: Millionaires on the Rise

The global millionaire population has surged past 60 million in 2025, driven by strong economic growth in key regions like North America and Asia. Rising stock markets, tech-driven wealth, and robust asset appreciation have fueled this expansion. Countries like India, China, and the U.S. are seeing record highs in high-net-worth individuals, reshaping global wealth distribution — especially within the Top 10 Millionaire Countries in 2025.

Top 10 Millionaire Countries in 2025

| Rank | Country | Estimated Millionaires (2025) |

|---|---|---|

| 1 | United States | 23.5 million |

| 2 | China | 6.2 million |

| 3 | Japan | 3.8 million |

| 4 | Germany | 2.9 million |

| 5 | United Kingdom | 2.8 million |

| 6 | France | 2.6 million |

| 7 | Canada | 2.1 million |

| 8 | Australia | 2.0 million |

| 9 | India | 1.6 million |

| 10 | South Korea | 1.4 million |

2025 Wealth Report: U.S. Hosts the World’s Largest Millionaire Population

The United States has reached an unprecedented milestone in 2025, emerging as the world’s leading hub for millionaires with an estimated 23.5 million high-net-worth individuals. This rapid wealth accumulation is powered by robust stock market performance, a thriving tech sector, and long-standing dominance in global finance. From real estate booms to startup success stories, multiple engines of growth continue to shape the U.S. wealth landscape. Its ability to attract foreign investment and foster innovation keeps the country at the forefront of global wealth creation.

China Ranks Second in Global Millionaire Count for 2025

In 2025, China ranks second globally in terms of millionaire population, with around 6.2 million individuals possessing high net worth. The country’s rapid economic development, strong manufacturing base, and expanding tech sector have driven significant private wealth accumulation. Urbanization, rising property values, and a surge in successful entrepreneurs have further fueled this growth. Despite global economic challenges, China continues to see a steady increase in millionaire households, solidifying its position as a global wealth powerhouse.

Japan Maintains Top Three Position in Global Millionaire Rankings

Japan, despite facing long-term economic stagnation and demographic challenges, retains its place in the top three countries with the highest number of millionaires in 2025. With around 3.8 million high-net-worth individuals, Japan’s wealth base remains resilient due to strong domestic savings, real estate value stability, and corporate equity holdings. Japan’s legacy of inherited wealth, combined with a cautious and long-term investment culture, has played a key role in sustaining and expanding private fortunes—ensuring the country remains firmly anchored among the world’s top millionaire economies.

Global Millionaire Count Surpasses 60 Million in 2025

By 2025, the global millionaire count has surpassed 60 million, up from 56 million the previous year — a notable indicator of accelerating wealth creation worldwide. This surge is driven by strong equity markets, rising property values, and growing entrepreneurship, particularly in emerging economies. Notably, the Top 10 Millionaire Countries in 2025—including the United States, China, Japan, Germany, the United Kingdom, France, Canada, Australia, India, and South Korea—account for a vast majority of the world’s high-net-worth individuals.

These nations are benefitting from stable economic policies, access to capital, and innovation-driven growth. The shifting landscape of wealth distribution highlights both the rise of new financial hubs and the resilience of established economic powerhouses in an increasingly interconnected world.

Germany and United Kingdom Lead Europe in Millionaire Rankings

Germany and the United Kingdom continue to lead Europe in terms of millionaire population in 2025. Germany, with an estimated 2.9 million millionaires, maintains its edge through a strong industrial economy, world-class engineering sectors, and a tradition of family-owned businesses. The United Kingdom closely follows with approximately 2.8 million millionaires, supported by its powerful financial services sector and international investment appeal. Despite facing economic headwinds, both nations show steady wealth growth. Key contributors include stock market performance, real estate investments, and a favorable environment for high-net-worth individuals to grow and manage their wealth efficiently.

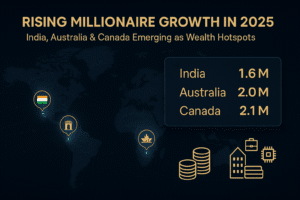

Millionaire Growth Surges in India, Australia, and Canada

The latest global wealth report highlights significant millionaire growth in India, Australia, and Canada in 2025. India has seen a sharp rise in high-net-worth individuals, reaching approximately 1.6 million millionaires, driven by a booming startup ecosystem, a thriving IT sector, and expanding middle-class wealth.

Australia, with around 2.0 million millionaires, continues to benefit from strong property markets, mining exports, and a stable economy. With an estimated 2.1 million millionaires in 2025, Canada continues to see consistent wealth growth, fueled by a strong property market, expanding tech industry, and supportive immigration policies that attract global talent and investors. These three nations are rapidly gaining ground in the global wealth landscape, emerging as attractive destinations for business growth, asset diversification, and long-term wealth creation.

Global Wealth Concentrates in Leading Economies

Global wealth in 2025 is increasingly concentrated within a small group of powerful economies, reflecting widening disparities in financial growth. Countries like the United States, China, Japan, and Germany now account for a significant share of the world’s millionaire population. This concentration is fueled by advanced capital markets, strong corporate sectors, and innovation-driven industries. As emerging markets grow, wealth remains heavily skewed toward nations with long-established financial systems, reinforcing their dominance in global economic and investment landscapes.

UAE and Singapore Attract Wealth with Pro-Business Policies

In 2025, the UAE and Singapore continue to emerge as leading destinations for high-net-worth individuals (HNWIs), thanks to their favorable tax structures, political stability, and business-friendly environments. The United Arab Emirates, particularly Dubai and Abu Dhabi, offers zero income tax, luxury living, and robust financial services, making it a magnet for wealthy investors and entrepreneurs. Similarly, Singapore’s strategic location, low corruption, world-class infrastructure, and ease of doing business have made it a top choice in Asia for global millionaires. Both nations are experiencing a steady influx of wealth migration, reinforcing their status as safe, efficient, and lucrative hubs for private wealth management and long-term financial planning.

Russia and South Africa See Drop in Millionaire Population Amid Economic Strain

In 2025, countries like Russia and South Africa have experienced a sharp drop in their millionaire populations, driven by ongoing geopolitical uncertainty, unstable economic conditions, weakening local currencies, and increased capital outflows. Many high-net-worth individuals from these regions are relocating to more stable countries with investor-friendly policies. While global wealth is growing overall, not all regions are benefiting equally. This contrast is especially clear when compared to the Top 10 Millionaire Countries, which continue to see consistent growth in private wealth and attract new millionaires through innovation, opportunity, and economic resilience.

You might also like

- Top 10 Best Cities for Nightlife Around the World

- Israel Defense Partners 2025: Top 10 Strategic Allies Revealed

Join our official WhatsApp Channel RealSource24 for breaking news, trending headlines, and real-time alerts — all in one place!